What Is a Good Gross Margin for a Staffing Firm? Benchmarks by Firm Type

If you run a staffing or recruiting firm, you have probably asked this question at least once:

Is my gross margin actually good?

Most owners look at revenue growth first. Margin comes second. Cash flow comes last. By the time margin becomes a real concern, the business already feels tighter than it should.

This article will help you understand what a “good” gross margin looks like for staffing firms, how benchmarks vary by firm type, and how to tell whether your margin is actually supporting a healthy business.

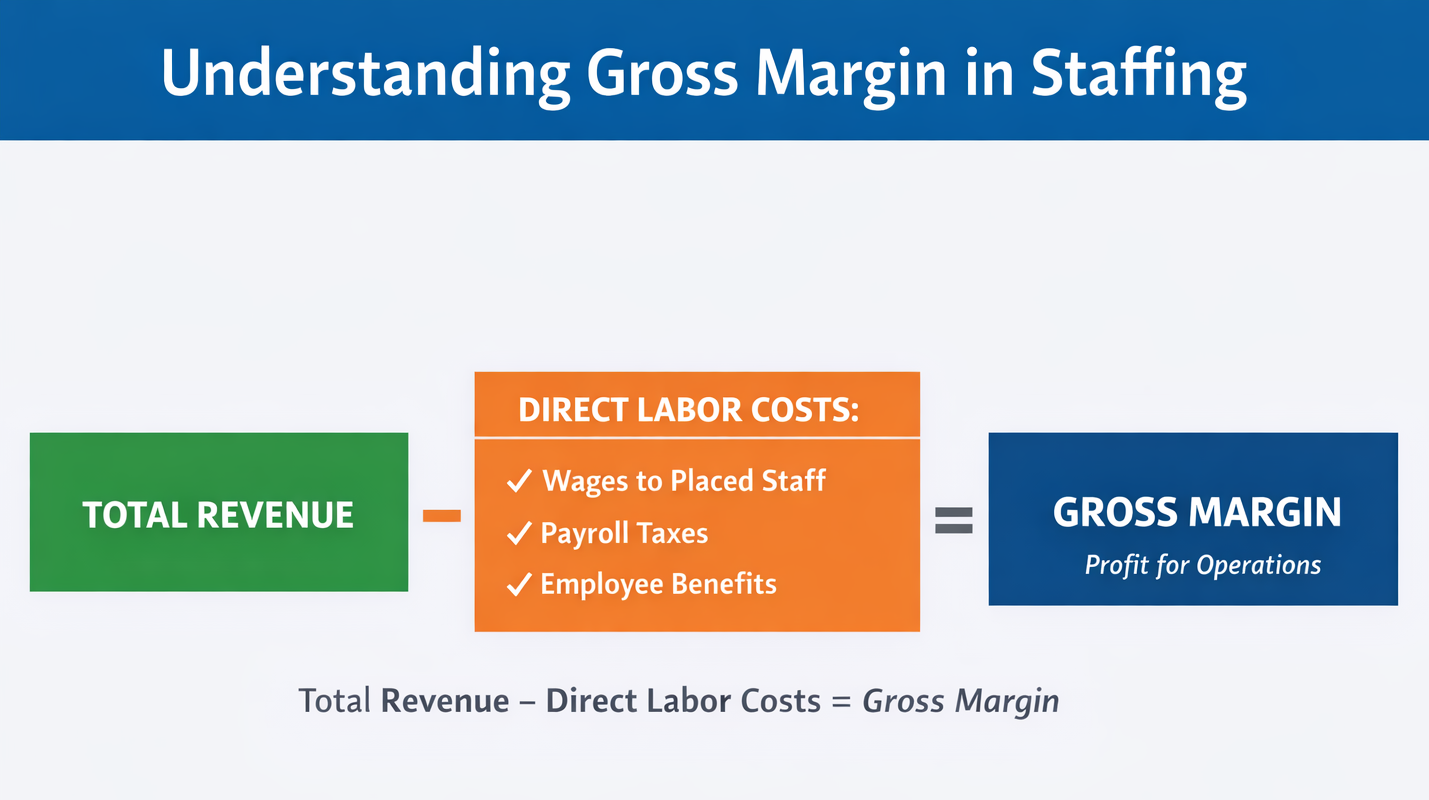

What Gross Margin Means in a Staffing Firm

At a basic level, gross margin is:

Revenue minus direct labor costs

For staffing firms, direct labor typically includes:

W2 wages paid to placed employees

Employer payroll taxes

Benefits tied directly to those employees

Gross margin does not include:

Internal recruiter salaries

Sales commissions

Software and tools

Office, insurance, or admin costs

Gross margin answers one question:

How much money is left after paying the people who generate revenue?

Everything else comes out of that remaining margin.

Gross Margin Benchmarks by Staffing Firm Type

There is no single “good” gross margin for all staffing firms. Benchmarks vary widely depending on the business model, client mix, and labor structure.

Below are typical ranges, not targets.

Temporary Staffing: ~18% to 25%

Lower margins are common due to:

Wage pressure

Client rate sensitivity

High payroll frequency

Firms on the lower end usually struggle with cash flow even when revenue grows.

Permanent Placement: ~40% to 60%

Higher margins reflect:

One-time placement fees

Lower payroll risk

Stronger pricing leverage

However, income volatility is higher and forecasting is harder.

IT or Technical Staffing: ~25% to 35%

Margins depend heavily on:

Skill specialization

Client concentration

Contract length

Well-run firms here can support higher overhead, but poor pricing discipline shows up fast.

Healthcare Staffing: ~20% to 30%

Margins vary based on:

Compliance costs

Credentialing requirements

Urgency of placements

High volume can mask thin margins until payroll timing creates stress.

Recruiting-Only Firms: ~45% to 70%

These firms often have:

Fewer direct labor costs

Higher reliance on recruiter productivity

Greater sensitivity to incentive structures

High gross margin does not automatically mean high profit.

Why “Good” Gross Margin Is Firm-Specific

Benchmarks are useful, but they are not enough.

Two firms with the same gross margin can have very different outcomes depending on:

Client concentration

Recruiter output

Pay rate vs bill rate discipline

Internal compensation structure

A firm with a 28% gross margin and strong systems may outperform a firm with a 35% margin and poor visibility.

A good margin should:

Cover overhead comfortably

Absorb slow-paying clients

Fund growth without constant stress

If it cannot do those things, it is not actually good.

Why Staffing Firm Margins Erode Over Time

Most margin problems are not sudden. They happen quietly.

1. Discounting to Win or Keep Clients

Small concessions add up, especially when wage costs rise but billing rates stay flat.

2. Labor Costs Increase Faster Than Rates

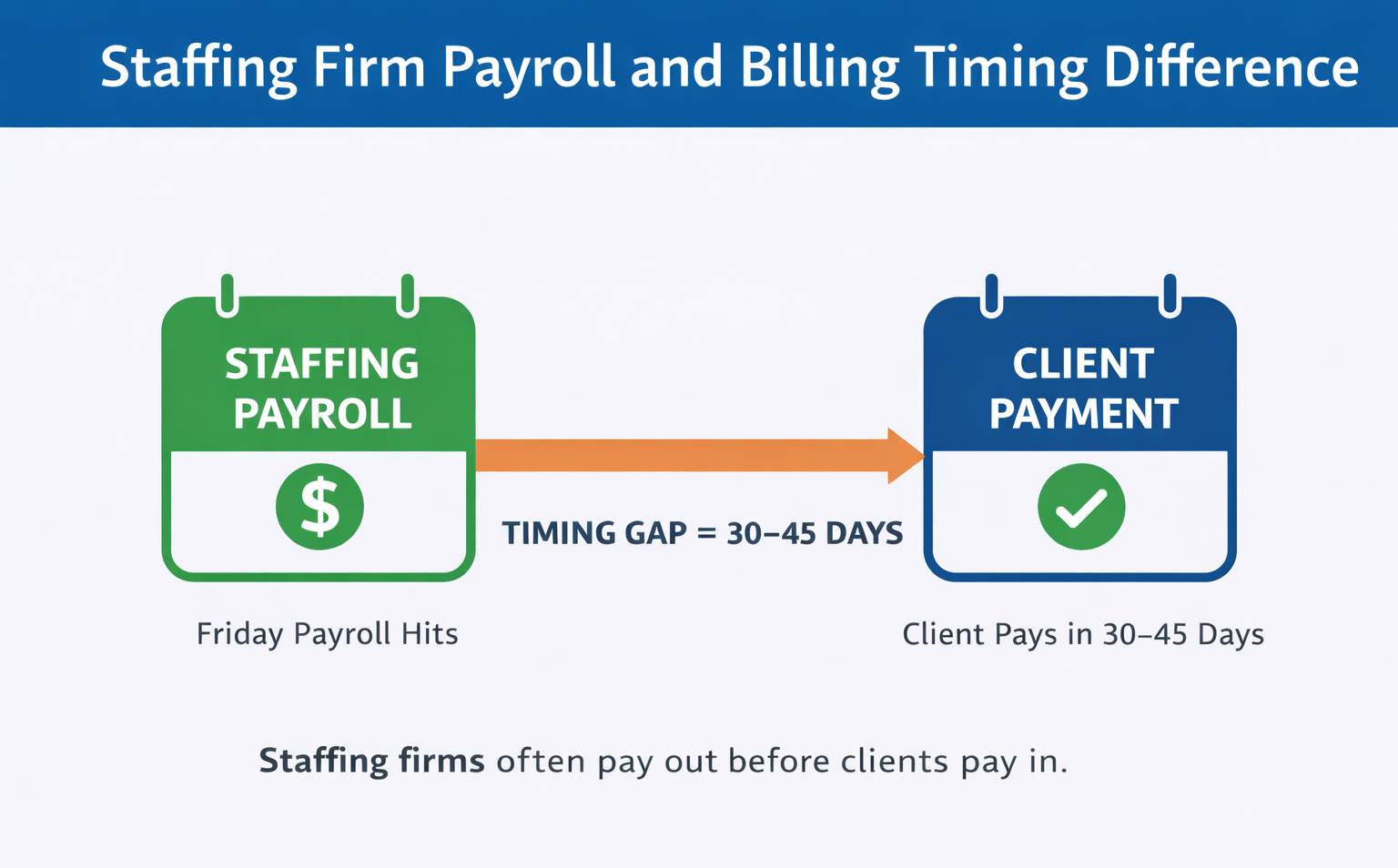

Payroll adjusts immediately. Client pricing often lags or never changes.

3. Poor Visibility by Client or Role

Average margin hides underperforming clients that slowly drag results down.

By the time owners notice, cash flow is already tight.

Warning Signs Your Gross Margin Is Not Healthy

Gross margin issues usually show up indirectly first.

Common warning signs include:

Revenue growth without cash improvement

Constant pressure to collect receivables

Payroll stress despite reported profitability

Surprises when financials are finalized

If any of these feel familiar, margin clarity is likely missing.

What to Do Before You Try to “Fix” Margin

The instinct is usually to raise prices or cut costs.

That can work, but only after you understand:

Margin by client

Margin by role or placement type

Timing differences between payroll and collections

Without that clarity, changes are guesses, not decisions.

Final Thought

A good gross margin is not about hitting a benchmark. It is about supporting a business that feels stable, predictable, and scalable.

If your numbers look fine but the business feels tight, gross margin deserves a closer look.

In our Accounting Review, we break down gross margin by client, role, and recruiter so staffing firm owners can see exactly where profit and cash flow are being created or lost.